कई निवेशक एफडी के एक और बेनिफिट के बारे में नहीं जानते हैं। जी हां, अगर कोई पुरुष अपने नाम की जगह पत्नी के नाम की एफडी करवाता है तो उसे अतिरिक्त लाभ मिलता है। इन बेनिफिट्स के बारे में कई निवेशक नहीं जानते हैं। हम आपको इन सभी बेनिफिट्स के बारे में बताने वाले हैं।

पत्नी को मिलता है TDS का लाभ

एफडी पर जो रिटर्न मिलता है उस पर टीडीएस (TDS) देना होता है। एफडी में मिलने वाला ब्याज एक तरह से निवेशक की कमाई में जुड़ जाता है। दरअसल, भारत में कई महिलाएं लोअर टैक्स ब्रैकेट में आती है। वहीं जो हाउसवाइफ होती है उन्हें जीरो टैक्स देना होता है।

अगर आप अपनी पत्नी के नाम से एफडी करवा सकते हैं तो आप एकहद तक टीडीएस बचा सकते हैं। वहीं, आप टैक्स भी बचा सकते हैं।

कितना बचेगा टीडीएस

अगर एक कारोबारी साल में एफडी पर 40,000 रुपये से ज्यादा का ब्याज मिलता है तो 10 फीसदी टीडीएस का भुगतान करना होगा। ऐसे में अगर बीवी के नाम पर एफडी है तो फॉर्म 15G भरकर टीडीएस बचा सकते हैं। वहीं, अगर पति-पत्नी ने मिलकर ज्वाइंट एफडी करवाया है और पत्नी फर्स्ट होल्डर है तो टीडीएस के साथ टैक्स पेमेंट करने से भी बच सकते हैं।

A fixed deposit account provides you with a safe investment option, where your funds are secured for a fixed amount of time while you earn a fixed rate of interest on the back of it.

There are different types of fixed deposits such as regular fixed deposits, senior citizen fixed deposits, cumulative or non-cumulative fixed deposits and many more

When you open your new FD account with My Deposit, the minimum amount required for a fixed deposit is ₹25000.

Here are some of the benefits of investing in Fixed deposit: high rate of interest on your investment, instant withdrawal or premature withdrawal benefits, a fully digital application process and much more.

Suppose you compare the interest rates for a general user against the interest rates offered to a senior citizen or woman. In that case, you will notice that the latter group usually gets higher rate of interest.

If your FD amount is more than ₹50,000, then the PAN card is mandatory.

There are no fixed eligibility criteria for opening a fixed deposit account at My Deposit. Anyone who is an Indian citizen and has all the documents required can invest.

The ideal tenure for your fixed deposit can differ between banking partners. The general tenure usually varies from 30 days to 10 years.

My Deposit offers special fixed deposit schemes for senior citizens, with interest rates up to 10.2%.

It is a different type of investment scheme where you keep on adding funds over the original FD. The interest is applied to your original investment amount, and then in the following cycle, you will get the benefit of the increased principal amount

Under Section 80C of the Income Tax Act of 1961, you can get a tax benefit of up to ₹1,50,000 for investing in a fixed deposit.

Yes, My Deposit offers pre-mature withdrawal benefits with its fixed deposit, available after 30 days of investing.

If you have made an FD investment with a tenure of less than 6 months, then your investment will be considered under simple interest. However, if it is above ₹50,000, you will get the benefit of compound interest.

Sweep-in is a form of fixed deposit where you can transfer the excess funds from your savings account to the FD account. A sweep-out facility is the exact opposite, where the deficit in your savings account is covered by transferring funds from the FD account.

Once your FD account has matured there are two options that you can choose from: renew your FD once again or transfer the entire amount back to your savings account.

- All Posts

- Banks

- Blog

- Finance

Unity Small Finance Bank About : Unity Small Finance Bank Unity Small Finance Bank has emerged as a critical player...

About : Bajaj Finance Ltd. (‘BFL’, ‘Bajaj Finance’, or ‘the Company’), a subsidiary of Bajaj Finserv Ltd., is a deposit...

About : Shriram Finance is the country’s one of the biggest retail NBFC offering credit solutions for commercial vehicles, two-wheeler...

About : Shivalik became the first Small Finance Bank in India to transition from an Urban Co-operative bank namely Shivalik...

Utkarsh Small Finance Bank Limited (USFBL),(NSE/BSE UTKARSHBNK) incorporated on April 30, 2016, is engaged in providing banking and financial services...

Ujjivan Small finance Bank About : Ujjivan Small Finance Bank (USFB) Limited is among the leading small finance banks in...

North East small finance bank About : North East Small Finance Bank North East Small Finance Bank (NESFB) has emerged...

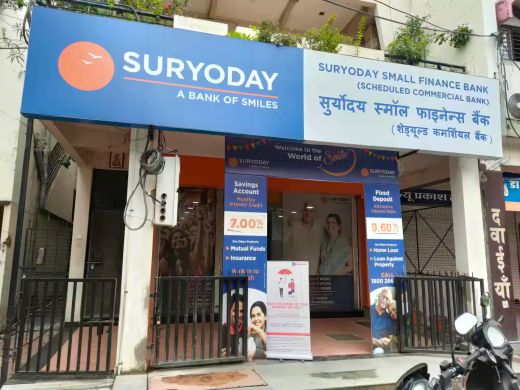

suryoday small finance bank About : Suryoday – ‘Sunrise’ in Sanskrit, signifies a new dawn, a new beginning and this...

What is Compound Interest? Compound interest is a fundamental concept in finance, representing the interest calculated on both the initial...